|

Wednesday, 26 March 2014

Mortgage Insurance Premium Increase - May 1st, 2014

Tuesday, 18 March 2014

Friday, 7 March 2014

A Friendly Reminder - Spring Forward This Weekend

|

Wednesday, 5 March 2014

Bank of Canada keeps policy interest rate unchanged at 1%

The Bank of Canada is keeping its trendsetting, overnight interest rate at one per cent, where it has been since September 2010.

It also made no changes to its neutral bias stance, meaning it believes the next policy move could equally be either a hike in rates or a cut.

Canada’s central bank says the current super-low interest rate is appropriate for the Canadian economy.

The bank says the economy grew a little more, and inflation was a little higher, than it anticipated in the final quarter of 2013.

However, the Bank of Canada cautioned that the global and domestic landscape remain beset by risks and uncertainties.

Best Mortgage Rates as of 5th March 2014

- 3 Years Fixed @ 2.59%

- 5 Years Variable @ Prime - 0.65 or 2.35%

- 5 Years Fixed @ 2.99% (30 days Quick Close)

- 5 Years Fixed @ 3.09%

Friday, 28 February 2014

CMHC to hike Mortgage Insurance Premiums

At the top end of the market for someone with a mortgage for 95% of the value of their home, the premium CMHC charges will go from 2.75% to 3.15%.

On a $450,000 mortgage, the fee — it is charged up front and often tacked onto the mortgage, would rise from $12,375 to $14,175.

CMHC controls about 70% of the mortgage default insurance market in Canada with private players Genworth Canada and Canada Guaranty holding the rest. Genworth announced it too would raise premiums across the board by an average of 15%. Its increases will take effect May 1 too.

Let's get your client's to move in before Wednesday April 30th 2014 to avoid paying extra payments if doing less then 20% down payment.

Thanks

Mihir

--

Mortgage Agent (License # M11000672)

The Mortgage Practice (Brokerage # 11156)

Tuesday, 18 February 2014

What do you expect from your REALTOR® ?

To Home sellers....

I don't give any guarantee to sell your home in 30 days, because it is not me or any REALTOR who dictate the market needs.

Since the current market is a seller's market so any home in current market going to sell in 30 - 60 days, as long as it priced right.

I believe in giving excellent yet affordable real estate services.

1) I always do free CMA (Comparable Market Analysis)

2) I always do open houses. Without any condition.

3) I help stage the property so that your dream home sell for top dollars

4) I make sure for smooth stress less transaction or it's free !!

5) I do advertise your property on following places to maximize the exposure of the property.

- My website (www.riteshjoshi.com),

- My Facebook page,

- My twiter account,

- My blog (www.riteshjoshi-realtor.blogspot.com),

- Send Newsletter to all my clients regarding your property.

- Prepare feature sheets

- Prepare estimated proceed to give you an estimate

After doing above, I don't need to guarantee you, whether your home is going to sell or not it has to sell in current hot real estate market.

To Home Buyers .....

I don't buy home for my clients, I want them to buy their home themselves, I believe in educating my clients so they can make their own judgment and make an informed decision.

- I educate my buyer clients about area

- I educate them about the buying process

- I educate them about different type of properties

- I show them properties until they completely understand the area and market price.

- Help them during home inspection of the property.

- Explain them about mortgage system and advise which mortgage to get using my associate mortgage brokers

- As token of appreciation, I pay for home inspection and lawyer's fee.

Because of my services, my clients are happy and due to that reason I always get referrals.

Thank you to my all clients who are great people and appreciate your co-operation.

Ritesh Joshi

Federal Budget Implications on Mortgage Broker Network

Many of the smaller lenders who focus on mortgages, offer us very competitive consumer rates and deal exclusively through Mortgage Brokers.

The increased competition means more mortgage options and choices when dealing with a mortgage broker instead of the banks. CMHC is also considering additional “flexible funding options” for smaller lenders which is great for us!

A recent Bank of Canada survey found that using a broker at the time of your mortgage renewal may result in getting a lower rate and saving money because mortgage brokers have the widest access to mortgage lenders.

The same survey found that loyal customers may not get as good of a deal with their bank as they would if they went to a different institution as a new customer. So dealing with a professional mortgage broker for all your mortgage needs just makes sense.

More choice, more convenience and more great counsel. Maybe we are bigger than the banks?

Mortgage Agent (License # M11000672)

The Mortgage Practice (Brokerage # 11156)

Monday, 17 February 2014

Fwd: Happy Family Day

- 3 years fixed at 2.59% - 60 days closing (15% pre-payments monthly and 15% annual payments)

- 5 years Variable at Prime - 0.65 or 2.35% - 90 days closing (15% pre-payments monthly and 15% annual payments)

- 5 years fixed at 3.09% - 60 days closing (15% pre-payments monthly and 15% annual payments)

- 5 years fixed at 2.99% - 30 days closing (5% pre-payments monthly and 5% annual payments)

Mortgage Agent (License # M11000672)

The Mortgage Practice (Brokerage # 11156)

Thursday, 6 February 2014

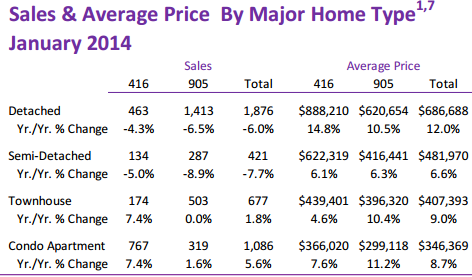

Real Estate market report for the month of Jan 2014 and historical home prices

Tuesday, 4 February 2014

Mihir's Market Matters Report - February 2014

|

| You have received this e-mail because you or someone who has a personal or family relationship with you, has requested it be sent. If you wish to be removed from the distribution list, simply reply to this email with subject line: UNSUBSCRIBE. Thanks and sorry for the inconvenience caused to you. |

Friday, 3 January 2014

Mihir's Market Matters Report - January 2014

|

You have received this e-mail because you or someone who has a personal or family relationship with you, has requested it be sent. If you wish to be removed from the distribution list, simply reply to this email with subject line: UNSUBSCRIBE. Thanks and sorry for the inconvenience caused to you. |